Break Even: The stock price(s) at which an option strategy results in neither a profit nor loss. Call: An option…

Example: Sell 1 put; buy 2 puts at lower strikeMarket Outlook: BearishRisk: LimitedReward: Limited, but substantialIncrease in Volatility: Typically helps…

Example: Sell 1 call; buy 2 calls at higher strikeMarket Outlook: BullishRisk: LimitedReward: UnlimitedIncrease in Volatility: Typically helps positionTime Erosion:…

Example: Buy 1 call with higher strike; buy 1 put with lower strikeMarket Outlook: Large move in either directionRisk: LimitedReward:…

Example: Buy 1 call; buy 1 put at same strikeMarket Outlook: Large move in either directionRisk: LimitedReward: UnlimitedIncrease in Volatility:…

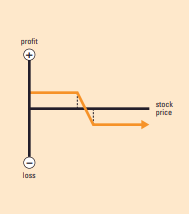

Example: Buy stock; sell calls on a share-for-share basis Market Outlook: Neutral to slightly bullish Risk: Limited, but substantial (risk…

Example: Buy call Market Outlook: Bullish Risk: Limited Reward: Unlimited Increase in Volatility: Helps position Time Erosion: Hurts position Break…

This strategy involves selling a call option and a put option with the same expiration and strike price. A short…

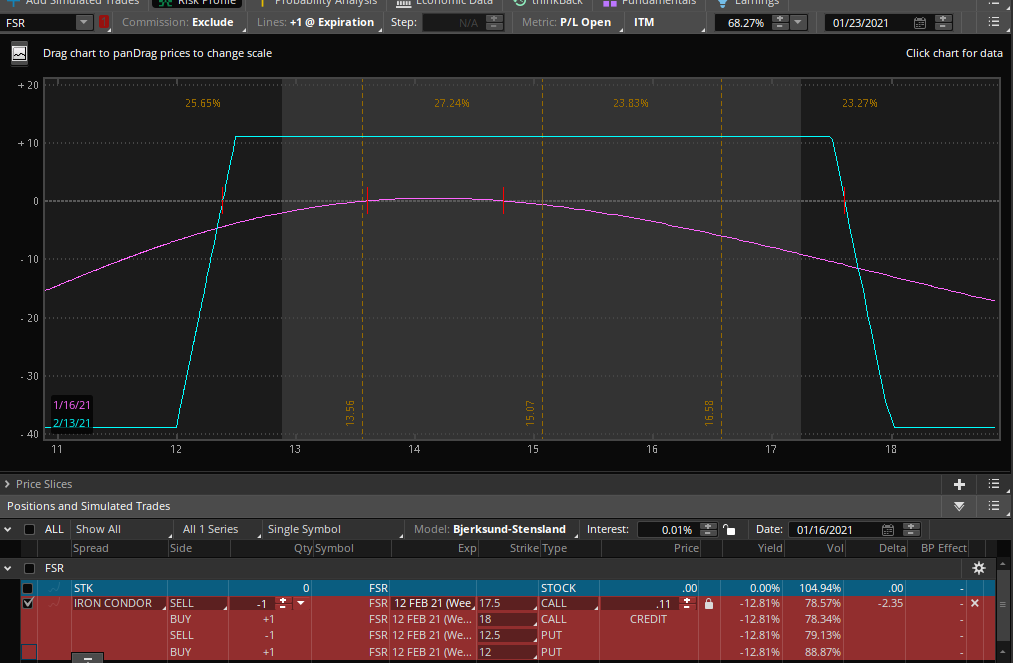

This strategy profits if the underlying stock is inside the inner wings (short strikes) at expiration. To construct a short…

Example: Sell 1 call; buy 1 call at higher strikeMarket Outlook: Neutral to bearishRisk: LimitedReward: LimitedIncrease in Volatility: Typically hurts…