Example: Sell 1 call; buy 1 call at higher strike

Market Outlook: Neutral to bearish

Risk: Limited

Reward: Limited

Increase in Volatility: Typically hurts position slightly

Time Erosion: Helps position

Break even: Short call strike plus credit received

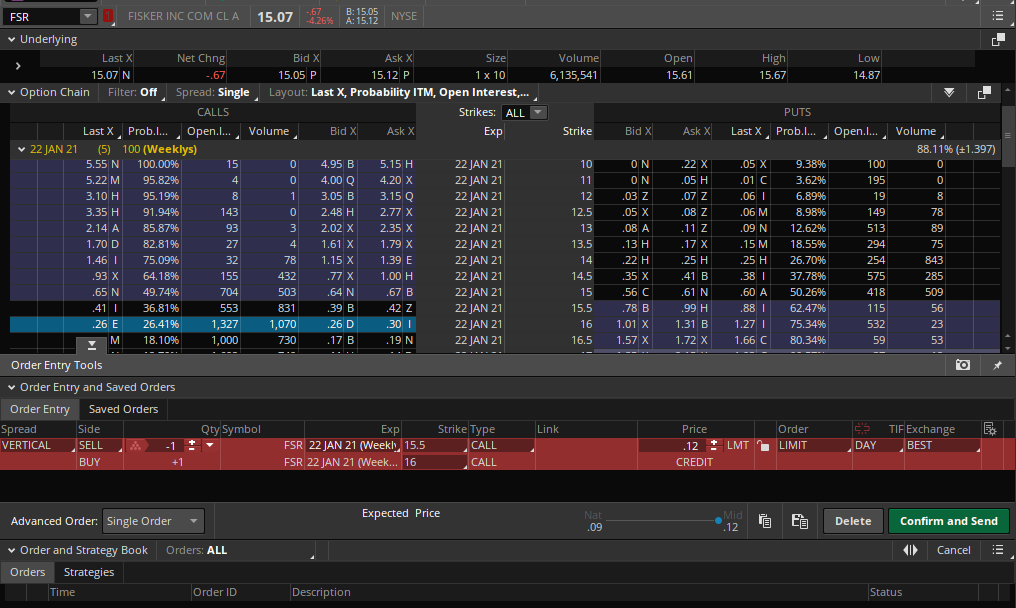

EXAMPLE

- Short 1 FSR 15.5 call

- Long 1 FSR 16 call

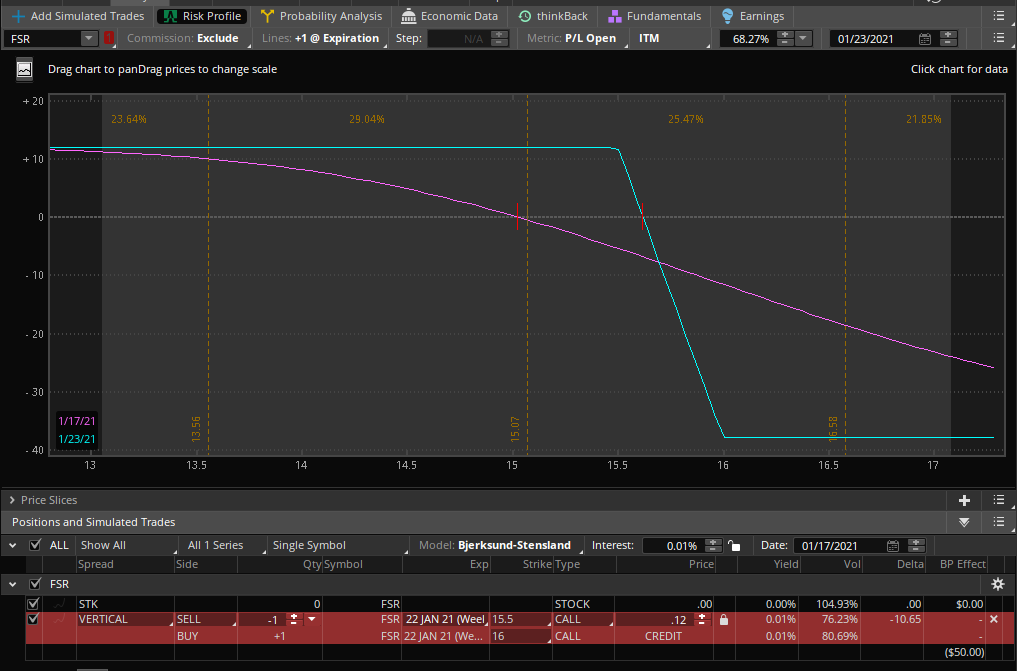

MAXIMUM GAIN

- Net premium received

MAXIMUM LOSS

- High strike – low strike – net premium received

The chief difference is the timing of the cash flows. The bear put spread requires a known initial outlay for an unknown eventual return; the bear call spread produces a known initial cash inflow in exchange for a possible outlay later on.

Outlook

Looking for a decline in the underlying stock’s price during the life of the options. As with any limited-time strategy, the investor’s long-term forecast for the underlying stock isn’t as important, but this is probably not a suitable choice for those who have a bearish outlook past the immediate future. It would take an accurately timed forecast to pinpoint the turning point where a coming short-term rally would turn into a bearish long term.

Summary

A bear call spread is a limited-risk, limited-reward strategy, consisting of one short call option and one long call option. This strategy generally profits if the stock price holds steady or declines.

The most it can generate is the net premium received at the outset. If the forecast is wrong and the stock rallies instead, the losses grow only until the long call caps the amount.

Motivation

The chance to earn income with limited risk, and/or profit from a decline in the underlying stock’s price.

Variations

A vertical call spread can be a bullish or bearish strategy, depending on how the strike prices are selected for the long and short positions. See bull call spread for the bullish counterpart.

Max Loss

The maximum loss is limited. The worst that can happen at expiration is for the stock price to be above the higher strike. In that case, the investor will be assigned on the short call, now deep-in-the-money, and will exercise the long call. The simultaneous exercise and assignment will mean selling the stock at the lower strike and buying the stock at the higher strike. The maximum loss is the difference between the two strikes, but it is reduced by the net credit received at the outset.

Max Gain

The maximum gain is limited. The best that can happen at expiration is for the stock to be below both strike prices. In that case, both the short and long call options expire worthless, and the investor pockets the credit received when putting on the position.

Profit/Loss

Both the potential profit and loss for this strategy are very limited and very well-defined. The initial net credit is the most the investor can hope to make with the strategy. Profits at expiration start to erode if the stock is above the lower strike price, and losses reach their maximum if the stock hits the higher strike price. Above the higher strike price, profits from exercising the long call completely offset further losses on the short call.

The way in which the investor selects the two strike prices determines the maximum income potential and maximum risk. By selecting a lower short call strike and/or a higher long call strike, the investor can increase the initial net premium income.

Breakeven

This strategy breaks even at expiration if the stock price is above the lower strike by the amount of the initial credit received. In that case the long call would expire worthless, and the short call’s intrinsic value would equal the net credit.

Breakeven = short call strike + net credit received

Volatility

Slight, all other things being equal. Since the strategy involves being short one call and long another with the same expiration, the effects of volatility shifts on the two contracts may offset each other to a large degree.

Note, however, that the stock price can move in such a way that a volatility change would affect one price more than the other.

Time Decay

The passage of time helps the position, though not quite as much as it does a plain short call position. Since the strategy involves being short one call and long another with the same expiration, the effects of time decay on the two contracts may offset each other to a large degree.

Regardless of the theoretical impact of time erosion on the two contracts, it makes sense to think the passage of time would be a positive. This strategy generates net up-front premium income, which represents the most the investor can make on the strategy. If there are to be any claims against it, they must be occur by expiration. As expiration nears, so does the date after which the investor is free of those obligations.

Credit to https://www.optionseducation.org and theocc.com for the educational description.