In this script, the lookback input specifies the number of bars to look back to identify accumulation and distribution periods. The threshold input allows you to adjust the sensitivity of the indicator to changes in trading volume.

The script calculates accumulation and distribution periods based on the principles of the Law of Cause and Effect. A cause is identified by a high volume bar with a close below the close of a lookback period, and a close of the lookback period below the close of a double lookback period. An effect is identified by a high volume bar with a close above the close of a lookback period, and a close of the lookback period above the close of a double lookback period.

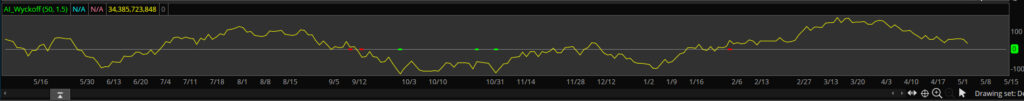

The script then plots horizontal lines to represent the accumulation and distribution areas.

Finally, the script calculates the strength of supply and demand based on the Law of Effort vs. Result, by multiplying volume by price movement and summing over the lookback period. This information is plotted as a line graph to represent the strength of supply and demand.

It is important to note that this indicator is not a standalone trading strategy and should be used in conjunction with other technical indicators and analysis. Additionally, as with any technical indicator, it is important to conduct thorough testing and analysis before

DOWNLOAD LINK: https://tos.mx/MM5Ftxi

The Wyckoff-based indicator I provided outputs two plot points: the accumulation and distribution areas, and the strength of supply and demand.

The accumulation and distribution areas are plotted as horizontal lines on the chart. The green line represents accumulation, which is an area where demand is greater than supply and prices are likely to rise. The red line represents distribution, which is an area where supply is greater than demand and prices are likely to fall.

When the price is in the accumulation area, it may present an opportunity to buy as prices are likely to rise. Conversely, when the price is in the distribution area, it may present an opportunity to sell as prices are likely to fall.

The strength of supply and demand is plotted as a yellow line on the chart. It represents the strength of demand when the line is above zero and the strength of supply when the line is below zero. The greater the strength of demand or supply, the further the line will be from zero.

When the strength of demand is high and increasing, it may present a buying opportunity as prices are likely to rise. Conversely, when the strength of supply is high and increasing, it may present a selling opportunity as prices are likely to fall.

It is important to note that the Wyckoff-based indicator is not a standalone trading strategy and should be used in conjunction with other technical indicators and analysis. Additionally, as with any technical indicator, it is important to conduct thorough testing and analysis before making trading decisions based on the indicator’s output.