Scanners to help you find great stock or options setups.

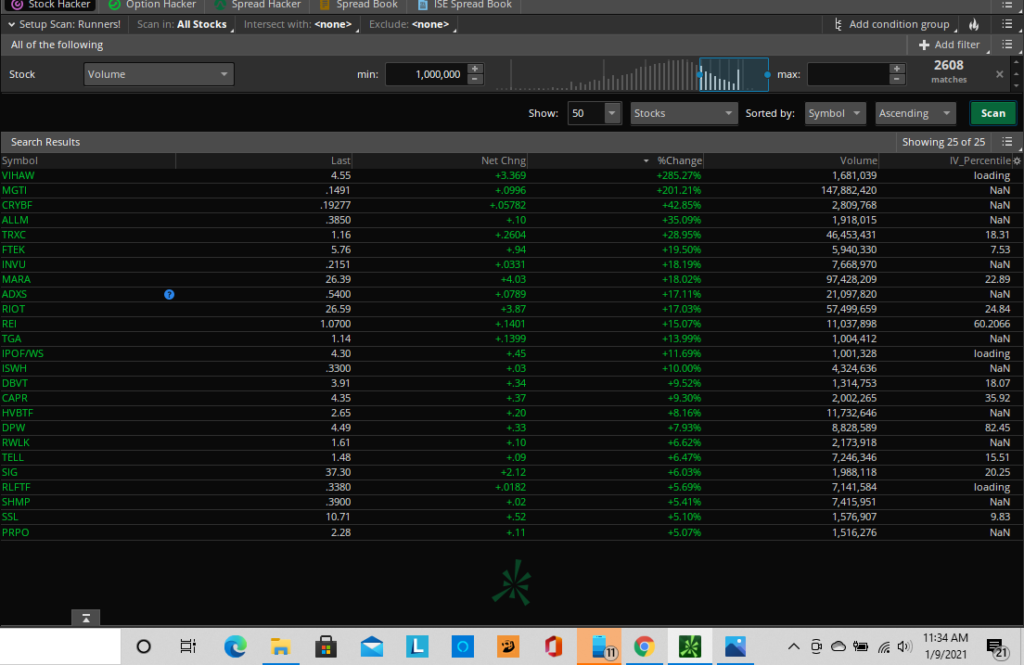

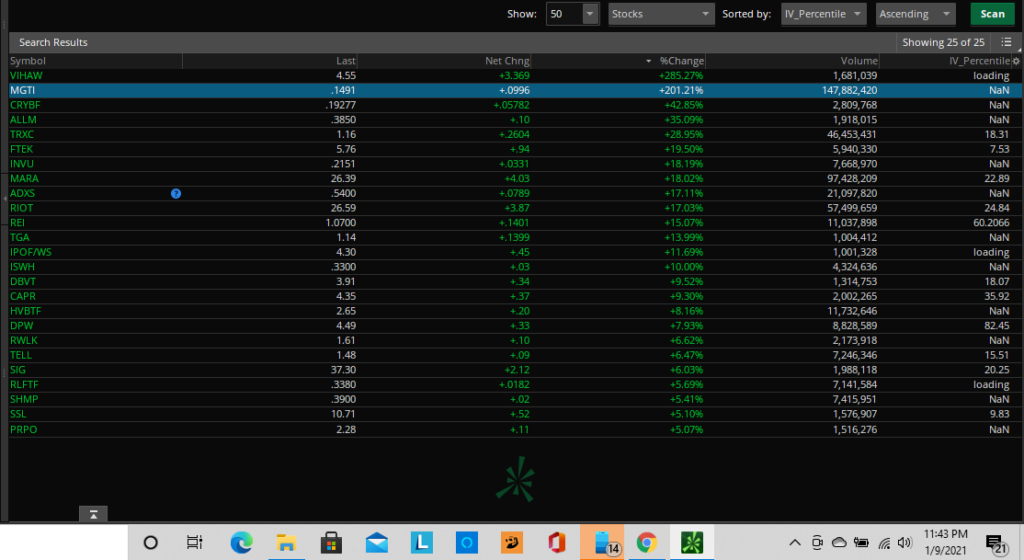

Runners Scanner For TOS

Runners scanner scans for stocks that are showing unusual volume and up a certain percentage. FREE!

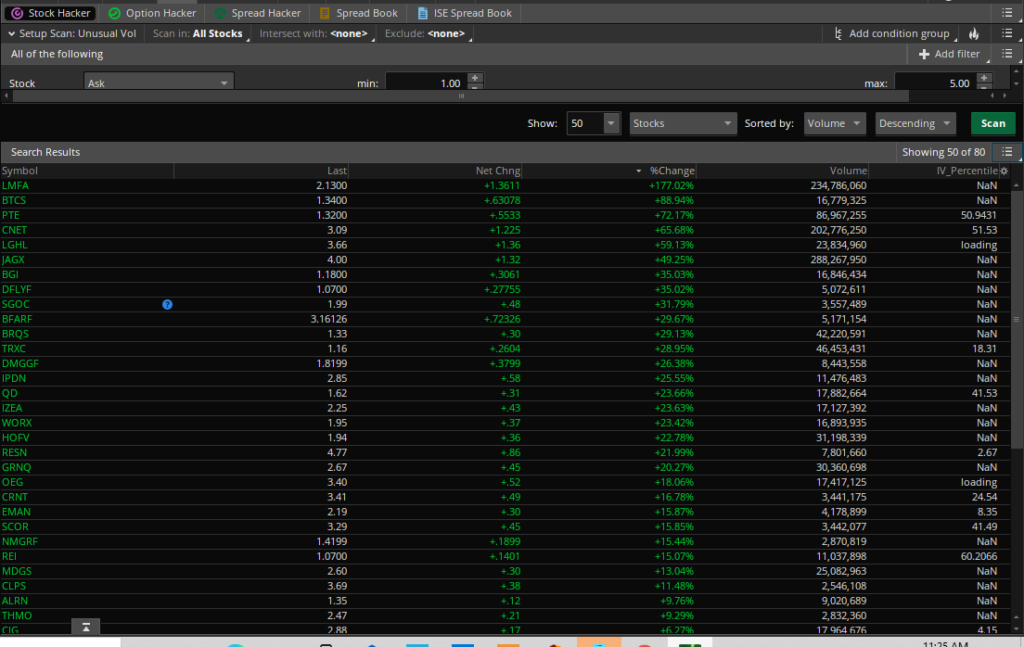

Unusual Volume Scanner

This powerful scanner consistently picks up huge gainers or losers. Best for quick day trades. FREE!

High IV Options

Great scanner for finding high IV options plays. FREE!

21 EMA Bullish

This Scanner picks up tickers that are close to but above the 21 EMA and bullishly stacked EMAs. FREE!

21 EMA Bearish

This scanner picks up tickers that are close to but below the 21 EMA and has bearishly stacked EMAs FREE!

TTM Zero line crossover Bearish

This scanner picks up stocks and ETFs that have just crossed over the zero line from bullish to bearish with bearishly stacked EMAs.

TTM Zero line crossover Bullish

This scanner picks up stocks and ETFs that have just crossed over the zero line from bearish to bullish with bullishly stacked EMAs.

Bullish Stacked EMAs with RSI Oversold

This scanner picks up stocks that have bullishly stacked EMAs but are oversold on the RSI.

Bearish Stacked EMAs with RSI Overbought

This scanner picks up stock that has bearishly stacked EMAs but is overbought on the RSI.

TTM Histogram Bullish

This scanner picks up stocks that have went from red to yellow (Negative momentum below the zero line to positive momentum below the zero line) From 2 bars ago.

TTM Histogram Bearish

This scanner picks up stocks that have went from cyan to blue on the TTM histogram (Positive momentum above the zero line to negative momentum above the zero line) within 2 bars.

Golden Bull

This scanner will pick up stock that has bullishly stacked EMAs, is trading above the 21 EMA and the MACD has crossed to the bullish side.

Golden Bear

This scanner picks up stocks that have bearishly stacked EMAs, is trading under the 21 EMA and the MACD has crossed under to the bearish side.