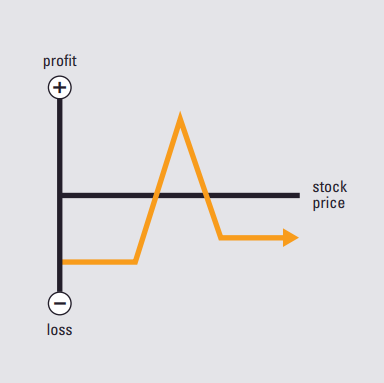

Example: Sell 2 calls; buy 1 call at next lower strike; buy 1 call at next higher strike (the strikes…

Example: Own stock; sell one call; sell one put; underlying price typically between short call and short put strikesMarket Outlook:…

Example: Sell 1 call; buy 1 call at same strike but longer expiration; also can be done with putsMarket Outlook:…

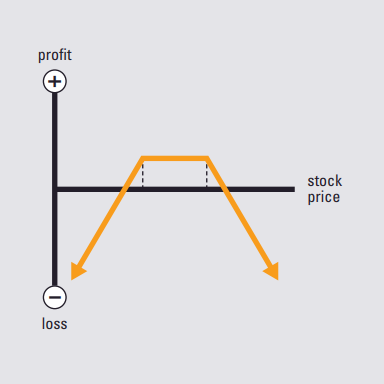

Example: Sell 1 call with higher strike; sell 1 put with lower strikeMarket Outlook: NeutralRisk: UnlimitedReward: LimitedIncrease in Volatility: Hurts…

Example: Sell 1 call; sell 1 put at same strikeMarket Outlook: NeutralRisk: UnlimitedReward: LimitedIncrease in Volatility: Hurts positionTime Erosion: Helps…

Example: Own stock, protect by purchasing 1 put and selling 1 call with a higher strikeMarket Outlook: Neutral to slightly…

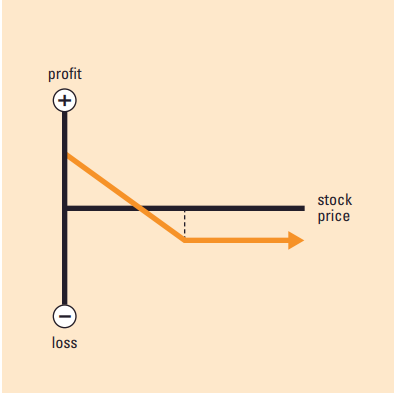

Example: Buy putMarket Outlook: BearishRisk: LimitedReward: Limited, but substantialIncrease in Volatility: Helps positionTime Erosion: Hurts positionBreak Even: Strike price minus…

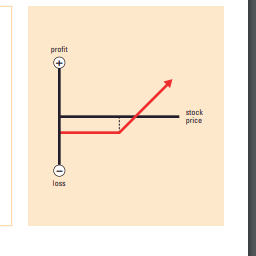

Example: Sell 1 put; hold cash equal to strike price x 100Market Outlook: Neutral to slightly bullishRisk: Limited, but substantialReward:…

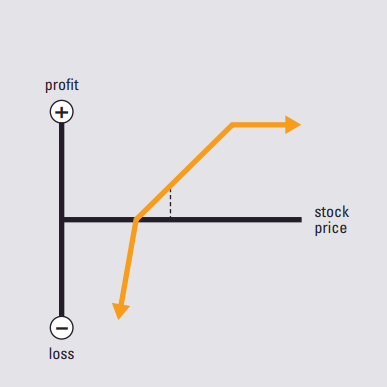

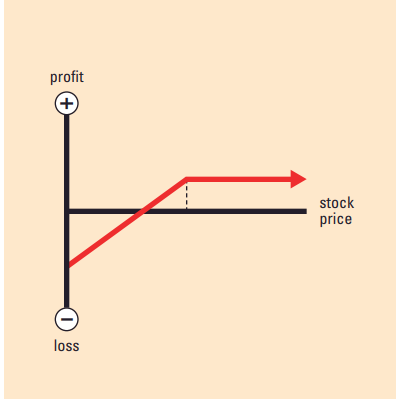

Example: Own 100 shares of stock; buy 1 putMarket Outlook: Cautiously bullishRisk: LimitedReward: UnlimitedIncrease in Volatility: Helps positionTime Erosion: Hurts…

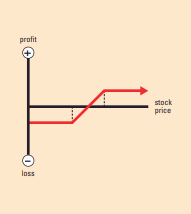

Example: Sell 1 put; buy 1 put at lower strike with same expiryMarket Outlook: Neutral to bullishRisk: LimitedReward: LimitedIncrease in…