Example: Sell 1 call; buy 1 call at same strike but longer expiration; also can be done with puts

Market Outlook: Near term neutral (if strikes = stock price); can be slanted bullish (with OTM call options) or bearish (with OTM put options)

Risk: Limited

Reward: Limited; substantial after near term expiry

Increase in Volatility: Helps position

Time Erosion: Helps until near term option expiry

Break Even: Varies; after near term expiry long call strike plus debit paid or (if done with puts) long put strike minus debit paid

This strategy combines a longer-term bullish outlook with a near-term neutral/bearish outlook.

Description

Short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. The strategy most commonly involves calls with the same strike (horizontal spread), but can also be done with different strikes (diagonal spread).

Outlook

Looking for either a steady to slightly declining stock price during the life of the near-term option and then a move higher during the life of the far-term option, or a sharp move upward in implied volatility.

Summary

This strategy combines a longer-term bullish outlook with a near-term neutral/bearish outlook. If the underlying stock remains steady or declines during the life of the near-term option, that option will expire worthless and leave the investor owning the longer-term option free and clear. If both options have the same strike price, the strategy will always require paying a premium to initiate the position.

EXAMPLE

- Short 1 XYZ near 60 call

- Long 1 XYZ far 60 call

MAXIMUM GAIN

- Unlimited

MAXIMUM LOSS

- Net premium paid

Motivation

The investor hopes to reduce the cost of purchasing a longer-term call option.

Variations

The strategy described here involves two calls with the same strike but at different expirations. A diagonal spread, involving two calls with different strikes as well as expirations, would have a slightly different profit/loss profile. The basic concepts, however, would continue to apply.

Max Loss

The maximum loss would occur should the two options reach parity. This could happen if the underlying stock declined enough that both options became worthless, or if the stock rose enough that both options went deep in-the-money and traded at their intrinsic value. In either case, the loss would be the premium paid to put on the position.

Max Gain

At the expiration of the near-term option, the maximum gain would occur should the underlying stock be at the strike price of the expiring option. If the stock were any higher, the expiring option would have intrinsic value, and if the stock were any lower, the longer-term option would have less value. Once the near-term option has expired worthless, the investor is left with simply a long call position, which has no upper limit on its potential profit.

Profit/Loss

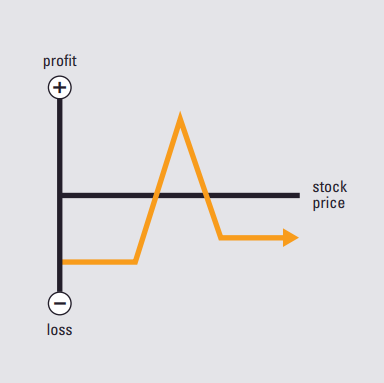

During the life of the near-term option, the potential profit is limited to the extent the near-term option declines in value more quickly than the longer-term option. Once the near-term option has expired, the strategy becomes simply a long call whose potential profit is unlimited. The potential loss is limited to the premium paid to initiate the position.

Breakeven

Since the options differ in their time to expiration, the level where the strategy breaks even is a function of the underlying stock price, implied volatility and rates of time decay. Should the near-term option expire worthless, breakeven at the longer-term option’s expiration would occur if the stock were above the strike price by the amount of the premium paid. But of course it could occur at any time should the position be closed out for a credit equal to the debit paid when the position was initiated.

Volatility

An increase in implied volatility, all other things equal, would have an extremely positive impact on this strategy. In general, longer-term options have a greater sensitivity to changes in market volatility, i.e., a higher Vega. Be aware, that the near-term and far-term options could and probably will trade at different implied volatilities.

Time Decay

The passage of time, all other things equal, would have a positive impact on this strategy in the beginning. That changes, however, once the near-term option has expired and the strategy becomes simply a long call whose value will be eroded by the passage of time. In general, an option’s rate of time decay increases as its expiration draws nearer.

Assignment Risk

Yes. Early assignment, while possible at any time, generally occurs for a call only when the stock goes ex-dividend. Should early exercise occur, using the the longer-term option to cover the assignment would require establishing a short stock position for one business day.

And be aware, a situation where a stock is involved in a restructuring or capitalization event, such as a merger, takeover, spin-off or special dividend, could completely upset typical expectations regarding early exercise of options on the stock.

Expiration Risk

Slight. Should the near-term call (the short side of the spread) be exercised when it expires, the longer-term call option would remain to provide a hedge. If the longer-term option were held into expiration, it may be exercised on the investor’s behalf by their brokerage firm if it’s in-the-money.

Comments

The difference in time to expiration of these two call options results in their having a different Theta, Delta and Gamma. Obviously, the near-term call suffers more from time decay, i.e., has a greater Theta. Less intuitively, the near-term call has a lower Delta but a higher Gamma (if the strike is at-the-money). This means that if the stock moves sharply higher, the near-term call becomes much more sensitive to the stock price and its value approaches that of the more expensive longer-term call.

A common variation of this strategy is to write another short-term option each time the previous one expires, until such time as the underlying stock moves significantly or the longer-term call approaches expiration.

Credit to https://www.optionseducation.org and theocc.com for the educational description.