Example: Sell 1 call with higher strike; sell 1 put with lower strike

Market Outlook: Neutral

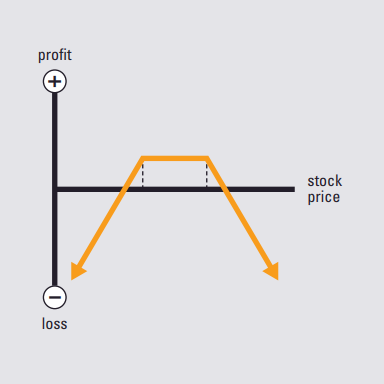

Risk: Unlimited

Reward: Limited

Increase in Volatility: Hurts position

Time Erosion: Helps position

Break Even: Two BEPs

- Call strike plus premium

received - Put strike minus premium

received

This strategy profits if the stock price and volatility remain steady during the life of the options.

Description

Selling a call and selling a put with the same expiration, but where the call strike price is above the put strike price is known as the short strangle strategy. Typically both options are out-of-the-money when the strategy is initiated.

Outlook

The investor is looking for a steady stock price during the life of the options.

Summary

This strategy tends to succeed if the stock price and volatility remain steady during the life of the options.

Motivation

Earn income from selling premium.

Variations

This strategy differs from a straddle in that the call strike is above the put strike; as a general rule, both the call and the put are out-of-the-money and close to equidistant from the underlying when initiated.

EXAMPLE

- Short 1 XYZ 65 call

- Short 1 XYZ 55 put

MAXIMUM GAIN

- Net premium received

MAXIMUM LOSS

- Unlimited

Strangles bring in less premium than straddles, but a larger move in the underlying stock is required before incurring a loss. Another variation of this strategy is the gut, where the call strike is below the put strike. Because both the call and put strike prices of a gut are usually in-the-money, at least one of them has to be, this strategy is very expensive and therefore rarely used.

Max Loss

The maximum loss is unlimited. The maximum loss occurs if the stock goes to infinity, and a very substantial loss could occur if the stock became worthless. In both cases the loss is reduced by the amount of premium received for selling the options.

Max Gain

The maximum gain is very limited. The maximum gain occurs if the underlying stock remains between the strike prices. In that case, both options expire worthless and the investor pockets the premium received for selling the options.

Profit/Loss

The potential profit is limited to the premium received for selling the options. Potential losses are unlimited on the upside and very substantial on the downside.

Breakeven

This strategy breaks even if, at expiration, the stock price is either above the call strike price or below the put strike price by the amount of premium received initially. At either of those levels, one option’s intrinsic value will equal the premium received for selling both options while the other option will be expiring worthless.

Upside breakeven = call strike + premiums received

Downside breakeven = put strike – premiums received

Volatility

An increase in implied volatility, all other things equal, would have a very negative impact on this strategy. Even if the stock price holds steady, a quick rise in implied volatility would push up the value of both options and force the investor to put up additional margin in order to maintain the position.

Time Decay

The passage of time, all other things equal, will have a very positive impact on this strategy. Every day that passes without a move in the stock price brings both options one day closer to expiring worthless.

Assignment Risk

Early assignment, while possible at any time, generally occurs for a call only when the stock goes ex-dividend or for a put when it goes deep in-the-money.

And be aware, a situation where a stock is involved in a restructuring or capitalization event, such as a merger, takeover, spin-off or special dividend, could completely upset typical expectations regarding early exercise of options on the stock.

Expiration Risk

An investor cannot know for sure whether or not they will be assigned on either the call or put until the Monday after expiration. If an assignment occurs unexpectedly, they will find themselves long or short the stock on the Monday following expiration and subject to an adverse move in the stock over the weekend.

Comments

This strategy is really a race between volatility and time decay. Volatility is the storm which might blow in at any moment and cause extreme losses. The passage of time is a constant that brings the investor every day a little closer to realizing their anticipated profit.

Credit to https://www.optionseducation.org and theocc.com for the educational description.