Example: Buy 1 call; buy 1 put at same strike

Market Outlook: Large move in either direction

Risk: Limited

Reward: Unlimited

Increase in Volatility: Helps position

Time Erosion: Hurts position

Break even: Two break even prices

- Call strike plus premium paid

- Put strike minus premium paid

This strategy consists of buying a call option and a put option with the same strike price and expiration.

Description

A long straddle is a combination of buying a call and buying a put, both with the same strike price and expiration. Together, they produce a position that should profit if the stock makes a big move either up or down.

Typically, investors buy the straddle because they predict a big price move and/or a great deal of volatility in the near future. For example, the investor might be expecting an important court ruling in the next quarter, the outcome of which will be either very good news or very bad news for the stock.

Outlook

Looking for a sharp move in the stock price, in either direction, during the life of the options. Because of the effect of two premium outlays on the breakeven, the investor’s opinion is fairly strongly held and time-specific.

Summary

This strategy consists of buying a call option and a put option with the same strike price and expiration. The combination generally profits if the stock price moves sharply in either direction during the life of the options.

EXAMPLE

- Long 1 XYZ 60 call

- Long 1 XYZ 60 put

MAXIMUM GAIN

- Unlimited

MAXIMUM LOSS

- Premiums paid

Motivation

The long straddle is a way to profit from increased volatility or a sharp move in the underlying stock’s price.

Variations

A long straddle assumes that the call and put options both have the same strike price. A long strangle is a variation on the same strategy, but with a higher call strike and a lower put strike.

Max Loss

The maximum loss is limited to the two premiums paid. The worst that can happen is for the stock price to hold steady and implied volatility to decline. If at expiration the stock’s price is exactly at-the-money, both options will expire worthless, and the entire premium paid to put on the position will be lost.

Max Gain

The maximum gain is unlimited. The best that can happen is for the stock to make a big move in either direction. The profit at expiration will be the difference between the stock’s price and the strike price, less the premium paid for both options. There is no limit to profit potential on the upside, and the downside profit potential is limited only because the stock price cannot go below zero.

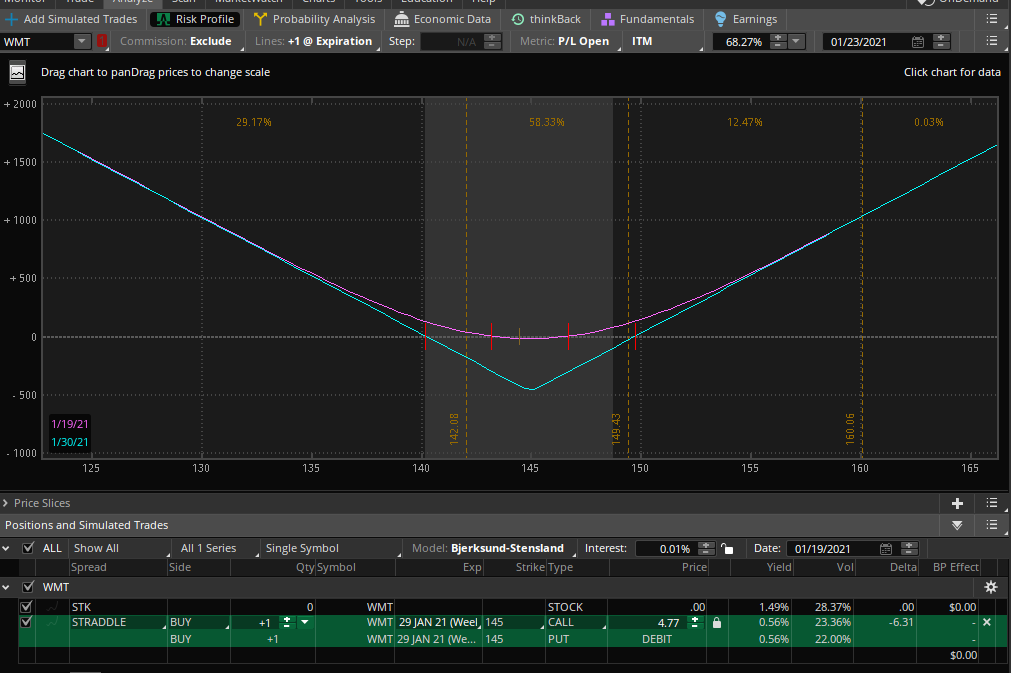

Profit/Loss

The maximum potential profit is unlimited on the upside and very substantial on the downside. If the stock makes a sufficiently large move, regardless of direction, gains on one of the two options can generate a substantial profit. And regardless of whether the stock moves, an increase in implied volatility has the potential to raise the resale value of both options, the same end result.

The loss is limited to the premium paid to put on the position. But while it is limited, the premium outlay isn’t necessarily small. Because the straddle requires premiums to be paid on two types of options instead of one, the combined expense sets a relatively high hurdle for the strategy to break even.

Breakeven

This strategy breaks even if, at expiration, the stock price is either above or below the strike price by the amount of premium paid. At either of those levels, one option’s intrinsic value will equal the premium paid for both options while the other option will be expiring worthless.

Upside breakeven = strike + premiums paid

Downside breakeven = strike – premiums paid

Volatility

Extremely important. This strategy’s success would be fueled by an increase in implied volatility. Even if the stock held steady, if there were a quick rise in implied volatility, the value of both options would tend to rise. Conceivably that could allow the investor to close out the straddle for a profit well before expiration.

Conversely, if implied volatility declines, so would both options’ resale values (and therefore, profitability).

Time Decay

Extremely important, negative effect. Because this strategy consists of being long a call and a put, both of them at-the-money at least at the beginning, every day that passes without a move in the stock’s price will cause the total premium of this position to suffer a significant erosion of value. What’s more, the rate of time decay can be expected to accelerate toward the last weeks and days of the strategy, all other things being equal.

Assignment Risk

None. The investor is in control.

Expiration Risk

Slight. If the options are held into expiration, one of them may be subject to automatic exercise. The investor should be aware of the rules regarding exercise, so that exercise happens if, and only if, the option’s intrinsic value exceeds an acceptable minimum.

Comments

This strategy could be seen as a race between time decay and volatility. The passage of time erodes the position’s value a little bit every day, often at an accelerating rate. The hoped-for volatility increase might come at any moment or might never occur at all.

Credit to https://www.optionseducation.org and theocc.com for the educational description.