Example: Sell 2 calls; buy 1 call at next lower strike; buy 1 call at next higher strike (the strikes…

Example: Own stock; sell one call; sell one put; underlying price typically between short call and short put strikesMarket Outlook:…

Example: Sell 1 call; buy 1 call at same strike but longer expiration; also can be done with putsMarket Outlook:…

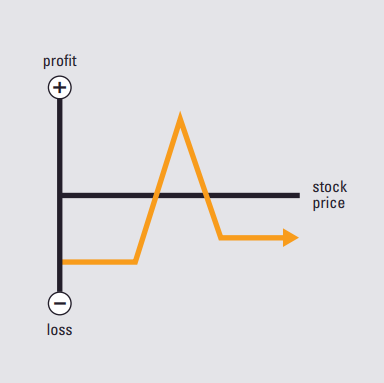

Example: Sell 1 call with higher strike; sell 1 put with lower strikeMarket Outlook: NeutralRisk: UnlimitedReward: LimitedIncrease in Volatility: Hurts…

Example: Sell 1 call; sell 1 put at same strikeMarket Outlook: NeutralRisk: UnlimitedReward: LimitedIncrease in Volatility: Hurts positionTime Erosion: Helps…

Example: Own stock, protect by purchasing 1 put and selling 1 call with a higher strikeMarket Outlook: Neutral to slightly…

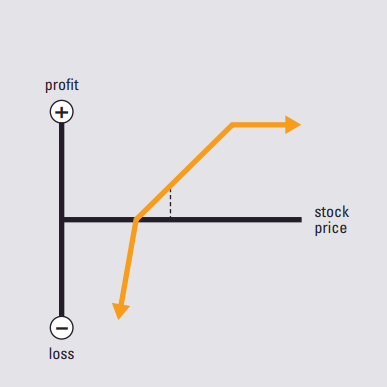

This strategy involves selling a call option and a put option with the same expiration and strike price. A short…

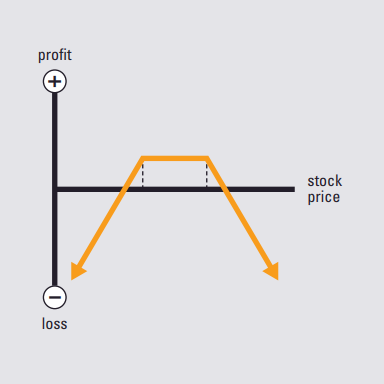

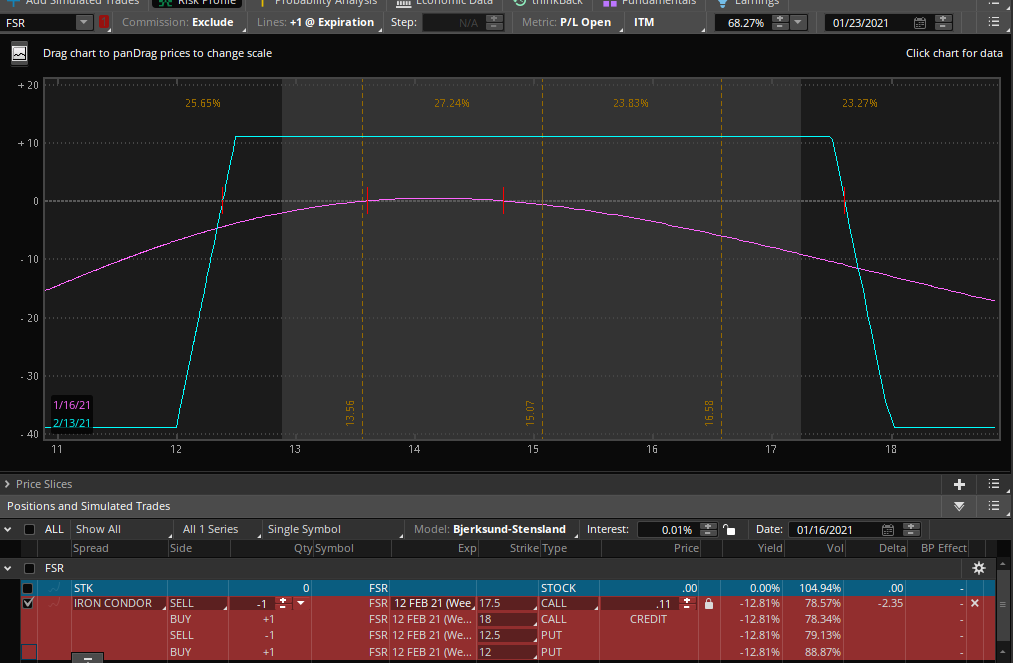

This strategy profits if the underlying stock is inside the inner wings (short strikes) at expiration. To construct a short…