Example: Sell 1 put; hold cash equal to strike price x 100Market Outlook: Neutral to slightly bullishRisk: Limited, but substantialReward:…

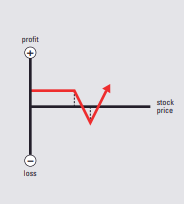

Example: Own 100 shares of stock; buy 1 putMarket Outlook: Cautiously bullishRisk: LimitedReward: UnlimitedIncrease in Volatility: Helps positionTime Erosion: Hurts…

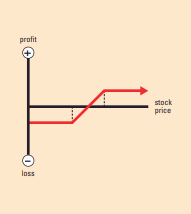

Example: Sell 1 put; buy 1 put at lower strike with same expiryMarket Outlook: Neutral to bullishRisk: LimitedReward: LimitedIncrease in…

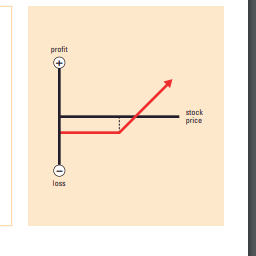

Example: Sell 1 call; buy 2 calls at higher strikeMarket Outlook: BullishRisk: LimitedReward: UnlimitedIncrease in Volatility: Typically helps positionTime Erosion:…

Example: Buy stock; sell calls on a share-for-share basis Market Outlook: Neutral to slightly bullish Risk: Limited, but substantial (risk…

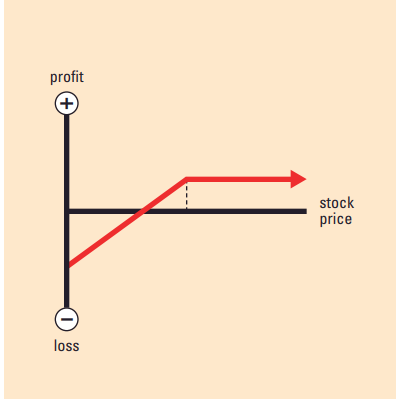

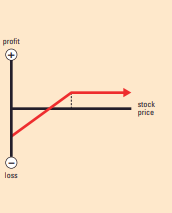

Example: Buy call Market Outlook: Bullish Risk: Limited Reward: Unlimited Increase in Volatility: Helps position Time Erosion: Hurts position Break…

With the call debit spread you will buy one call and sell one call further from the money to lower…